Real Cash Flow Must Be Discounted by the

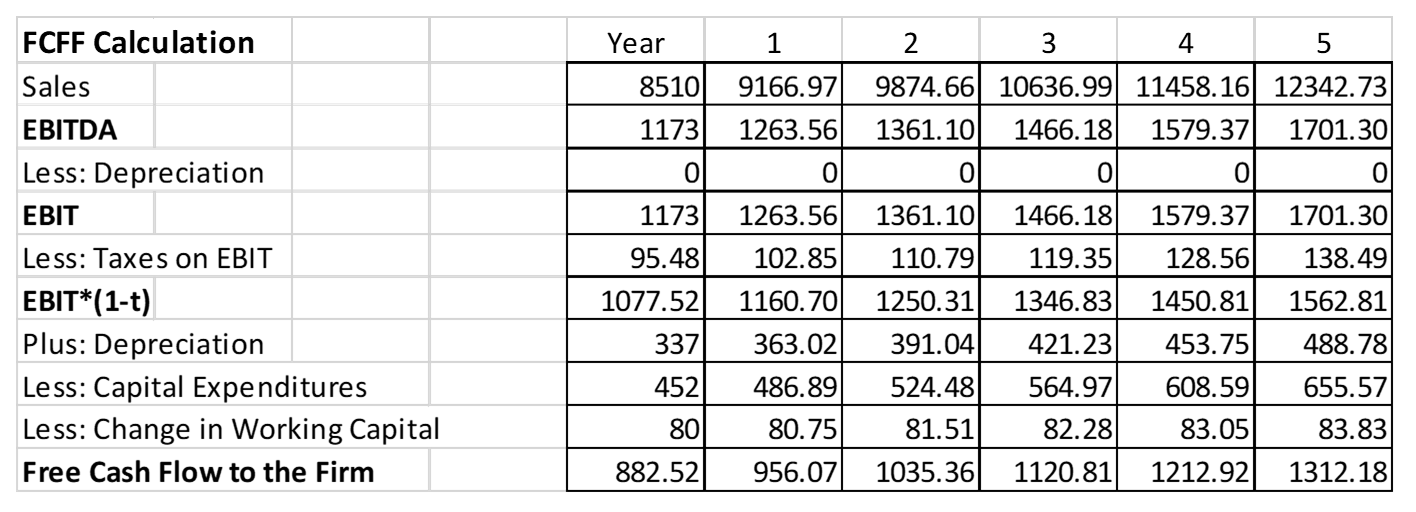

Recall that nominal cash flows must be discounted using nominal rates and real cash flows must be discounted using real rates. Because of this robustness the DCF model can be complex incorporating.

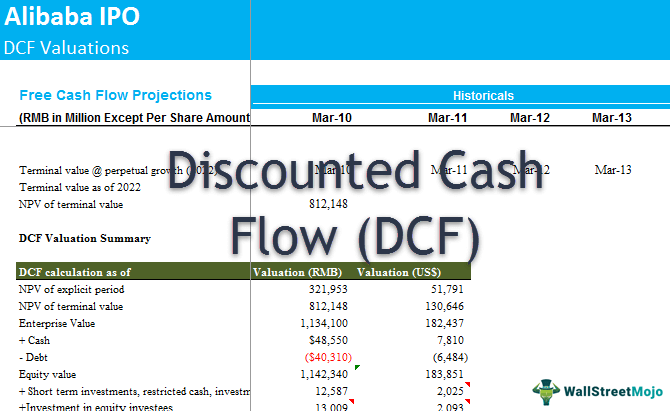

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Money Discount Rate Inflation Rate Real Discount Rate Risk free rate of interest.

. B 1 real rate of interest 1 nominal rate of interest 1 inflation rate cThe actual real rate of interest almost equals nominal rate of interest - inflation rate. A Money Discount Rate b Inflation Rate c Real Discount Rate d Risk free rate of interest. Financing costs like interest and principal payments on borrowed funds must be included in the incremental cash flows for the project.

D Real cash flows must be converted to nominal cash flows. 101 1 x. Houses 5 days ago Discounted Cash Flow Template.

A Real cash flows must be discounted at a real discount rate. The better the numbers the best the valuation is going to be. Financing costs like interest and principal payments on borrowed funds must be included on the incremental cash flows for the project.

D real cash flows must be discounted by a nominal discount rate BC True or false. Cash Flow Statement. E Real cash flows must be discounted using a real rate.

Nominal cash flows must be discounted by a nominal discount rate Real cash flows must be discounted by a real discount rate True or False. Real rate of return is equal to. Use this simple easy-to-complete DCF template for valuing a company a project or an asset based on future cash flowEnter year-by-year income details cash inflow fixed and variable expenses cash outflow net cash and discounted cash flow present.

The Real Cashflows must be discounted to get the present value M at a rate equal to. The Real Cashflows must be discounted to get the present value at a rate equal to. Correct - Your answer is correct.

1 real rate of interest 1 nominal rate of interest 1 inflation rate 3. You should multiply the discount rate by general rates. The Real Cashflows must be discounted to get the present value at a rate equal to.

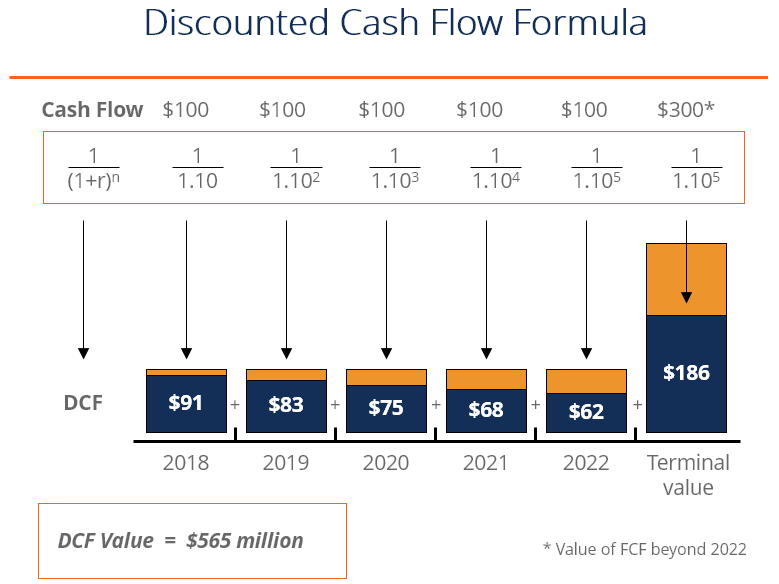

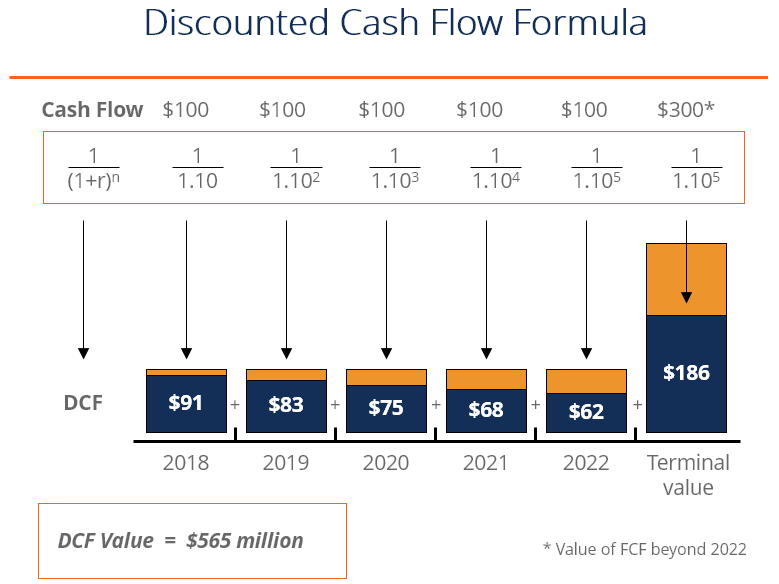

The DCF value can be compared to what the investment is currently selling for to see if it is a worthwhile opportunity. Meaning Objectives and Importance of Cash Flow Statement. Real cash flow can be useful for analyzing a companys current cash flow in relation to the past.

Assume that the real interest rate is 3 per year and inflation is expected to be constant at 2 per year. Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. Discounting real cash flows to real cash flow In other words inflation does not matter when using the real method as compared to a discount rate alone.

Free Discounted Cash Flow Templates Smartsheet. For example lets say that a certain company had cash flow of 10 million in 2000 and expects. A Money Discount Rateb Inflation Ratec Real Discount Rated Risk free rate of interest 8.

MCQ FINANCIAL MANGEMENT ASSI. 1 real rate of interest 1 nominal rate of interest1 inflation rate The actual real rate of interest almost equals nominal rate of interest - inflation rate Inflation rate Nominal rateReal rate - 1. There must be an additional discount ratio of 001 if discounts and inflation percentages are 10 and 15 respectively.

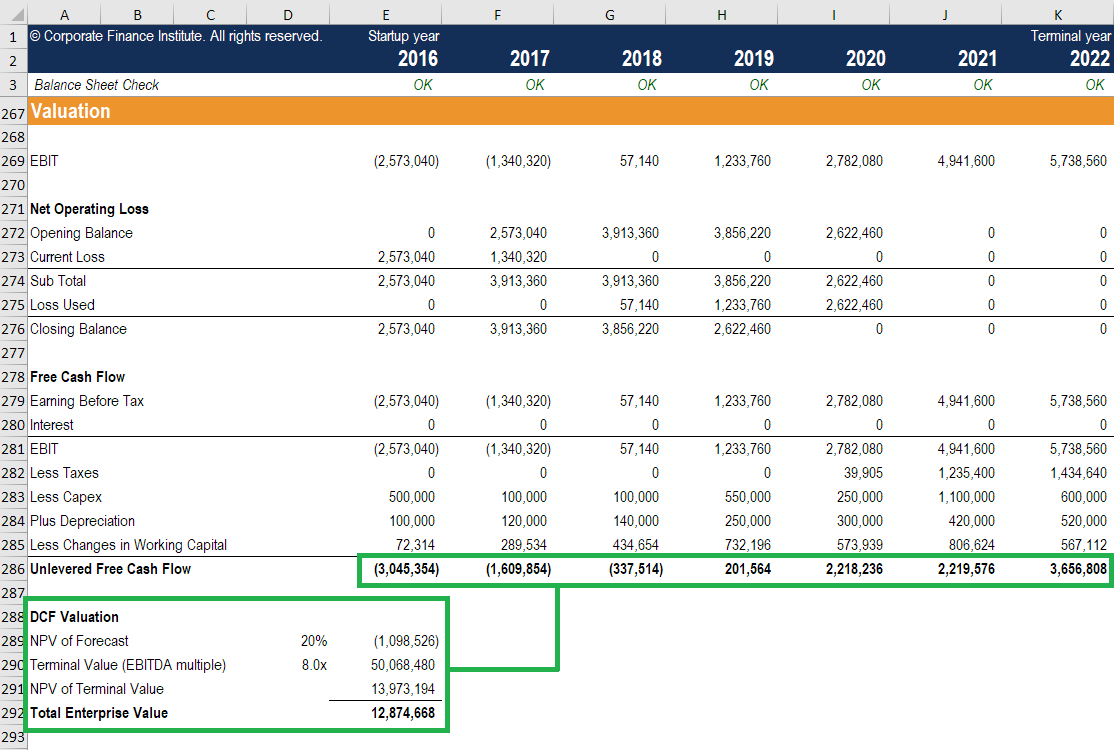

A Nominal Rate Inflation Rate b Nominal Rate Inflation Ratec Nominal Rate - Inflation Rated Nominal Rate Inflation Rate. While other methods such as income capitalization and price per square foot analysis are useful the DCF is by far the most robust valuation method available to real estate professionals. As you can see various pieces of financial data must be put together to calculate the discounted cash flow value.

The Real Cashflows must be. As part of this process this course will introduce the various Excel functions required to develop dynamic models to assist decision-makers. The discounted cash flow DCF is the bedrock of valuation in the commercial real estate industry.

Real cash flows must be discounted at a real discount rate. Real cash flows must be discounted at a real discount rate. C Nominal cash flows must be discounted using a real rate.

Hussey Hussey 1999 have pointed out the important thing to remember is real cash flows must only be discounted by the real interest rates while the nominal cash flows must only be discounted by the nominal interest rates. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond. The Real Cashflows must be discounted to get the present value at a rate equal to.

To be successful these tools must. Real cash flow must be discounted by the nominal interest rate. GARDI SCHOOL OF MANAGEMENT.

DCF analysis attempts to figure out the value of an investment. B The discount rate must be stated in real terms. Youll discover how a discounted cash flow model can be used to deliver sound real estate investment and financial decision-making through hands-on practical exercises.

Wrong - Your answer is wrong. After calculating the present value of future cash flows in the initial 10-year period we need to calculate the Terminal Value which accounts for all future cash flows beyond the first stage. Because the real cash flows does not include the affect of inflation and discounting by the nominal interest rate will both automatically but.

Dcf Model Training The Ultimate Free Guide To Dcf Models

Explaining The Dcf Valuation Model With A Simple Example

Walk Me Through A Dcf Analysis Investment Banking Interviews

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

Discounted Cash Flows Vs Comparables

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

Using Discounted Cash Flow Analysis For Commercial Real Estate Freedom Venture Blog

No comments for "Real Cash Flow Must Be Discounted by the"

Post a Comment